Broaden your knowledge as we provide you with an in-depth review of Payoneer, its features, and how it compares with other platforms for money transactions.

What Is Payoneer?

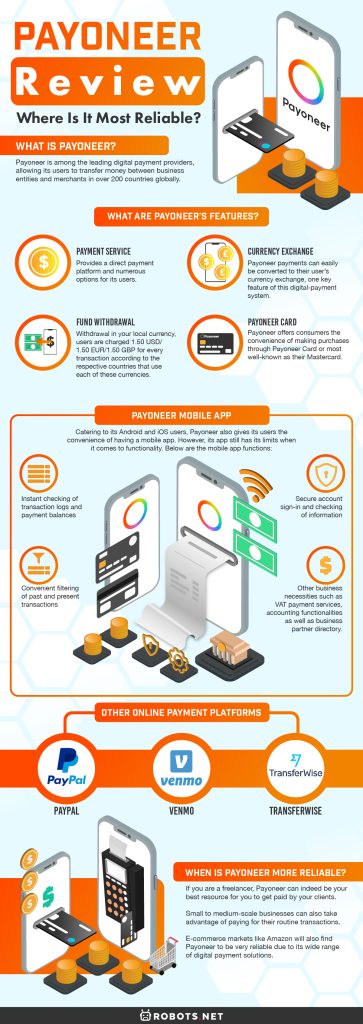

Payoneer is among the leading digital payment providers, allowing its users to transfer money between business entities and merchants in over 200 countries globally. The money being transferred between their partners is also called Payoneer payment or international payments, which are payments stored in your digital wallet or card. Payoneer has focused its target market solely on business owners, freelancers, professionals, products, and service providers that are based internationally. It highlights one of its most competitive features, international payment, which provides up to 150 currency conversion options to its users. This platform provides a direct payment platform and numerous options for its users to pay their contractors, employees, supply chain, and other business partners.

How to Sign Up?

Creating an account with Payoneer is essentially similar to almost all the e-payment platforms available on the market. To do so, you need to go to their website, where you could then click “Register” on the website’s top right tabs. Upon clicking the “Register,” you will then have to choose whether you’ll be using Payoneer as a Freelancer, Online Seller, or an Online Outsourcing Agency. Once you’ve decided, the platform will need the details required to verify your identity. Other than personal information and password, you may also enter your bank account details. To verify your account, scan through your registered email and click the link sent by Payoneer. As an added security feature, Payoneer prompts you to security questions as well as a credit check. This verification process takes about two days, and once approved, you can now enjoy the perks of having an e-wallet for your business needs. This sign-up process is also cost-free, so no need to worry about fees, at least for that part.

What Are Payoneer’s Features?

Similar to other online payment solutions, Payoneer users need to sign up for free. Once done, users can now enjoy the following features.

Payment Service

The first payment method is by triggering a payment request or having the client select the “Make a Payment” option, a free service. With this method, the platform links the user’s account with the client’s, providing clients with e-payment options. This option will take a few days to process which would depend on the client’s payment choice. The second payment mode is via the Global Payment Service, which is free for currencies: EUR, GBP, JPY, AUD, CAD, and CNY. However, for USD, fees can range from zero to 1%, which is dependent on the origin of the payment. For Global Payment Service or Payoneer international payment, they will be given local receiving accounts for users to receive their payment, which are comparative to local bank accounts. Once Payoneer has set this up, consumers can now enjoy hassle-free local bank transfers that are already converted into their local currencies. With international payments, clients’ funds through a local receiving account are directly added to the user’s e-wallet. Consumers could also receive payments through credit or debit card transfers subject to a 3% fee. Similarly, receiving funds can also be done via eCheck, but with a restriction when transferring USD currency due to a 1% fee for every transaction. Aside from the fees mentioned above, it is also possible for marketplaces to set fees that may vary depending on that particular network’s preference.

Currency Exchange

Payoneer payments can easily be converted to their user’s currency exchange, one key feature of this digital-payment system. Although international payments may be subject to a 0.5% fee above the set standard bank rate for exchanging currency.

Fund Withdrawal

To withdraw your money, a different fee is charged, which depends on whether you will be withdrawing your funds in the same currency that was deposited or in another currency. For international payment withdrawals, users will have to pay a 2% fee above the set interbank rate. As for Payoneer payment withdrawal in your local currency, users are charged 1.50 USD/1.50 EUR/1.50 GBP for every transaction according to the respective countries that use each of these currencies. However, fees may change as the value of your transaction gets higher.

Payoneer Card

Payoneer also offers consumers the convenience of making purchases through Payoneer Card or most well-known as their Mastercard. With a Payoneer card, users can purchase products other than the card’s locally set currency. The platform automatically converts using its official currency conversion rates. However, on top of this conversion rate, Payoneer charges a Payoneer conversion fee set at 3.5% of the converted amount.

Payoneer Mobile App

Catering to its Android and iOS users, Payoneer also gives its users the convenience of having a mobile app. However, its app still has its limits when it comes to functionality. Below are the mobile app functions:

Instant checking of transaction logs and payment balances Convenient filtering of past and present transactions Secure account sign-in and checking of information Other business necessities such as VAT payment services, accounting functionalities as well as business partner directory.

As to how Payoneer works, it is, without a doubt, a convenient tool for people in business and professionals alike. With payment features that provide e-payment solutions to a wide variety of users worldwide. Payoneer does secure a sure lead for other incoming players. However, it is still very limited in terms of its chosen market. Because despite its advantage with regards to international payments. A lot of the tech-savvy population couldn’t enjoy this feature for their personal needs to transfer funds for their family or friends. Get it for Android Get it for iOS

Our Take on Payoneer’s Features

Payoneer’s features are undoubtedly the leading digital-payment platform in terms of how vast its market is. It doesn’t only cater to a wide range of consumers. But, it also offers numerous e-payment solutions that allow client-customer transactions fast and easy. Apart from Payoneer’s capabilities in terms of connectivity. One of the features that give them an even more significant leap is their automatic currency conversion services. However, given that Payoneer is still a business that’s continuously evolving as a better service provider. Funds are indeed a way to keep pursuing this vision. With the different Payoneer fees, users are somehow restricted to using the full potential of Payoneer’s offered services. These Payoneer fees, although individually low, will eventually add up, leaving users with high charge rates. Other than the fees discussed alongside Payoneer’s features, other expenses add to the consumer’s Payoneer costs that Payoneer no longer controls. These fees include:

Charges imposed by banks when transferring money using a debit account. Wire transfers. Swift transfers. Fees charged by beneficiary banks. Processing fees levied by intermediary banks.

So, with Payoneer fees and other fees outside Payoneer’s control, users could receive less of what is actually shown on their Payoneer accounts. Other than the unfortunate situation regarding fees, currency exchange can only be an option when the cost recipient is a Payoneer account holder or vice versa. Otherwise, this feature is not available. Lastly, despite Payoneer’s advantageous feature regarding currency conversion. Unfortunately, personal transactions are not available due to Payoneer’s transaction nature. Which solely focuses on business-to-consumer fund transfers.

Payoneer vs. Other Online Payment Platforms

To better provide a review that is worthy of your curiosity. Here are comparisons with their top competitors.

PayPal

PayPal has been on the market alongside Payoneer – making it their top competitor. PayPal’s difference is that it can cater to peer-to-peer transactions, securing a better advantage as opposed to the latter’s business-focused transactions. In terms of credit and debit card transfer charges, Paypal has a lower rate of $0.25. However, in terms of currency conversion routes and speed of payments. Payoneer has a more significant advantage as opposed to PayPal’s 26 country range. As well as its three to five days of payment processing time. Check out these top PayPal alternatives.

Venmo

Venmo, although considerably different in marketing strategies, also poses a competition against Payoneer. Nowadays, people are more inclined to take advantage of the convenience of digital payments. Payoneer, with its current structure, loses a significant advantage in this aspect. As more and more people opt to use e-payment for their daily transactions. However, Venmo is an in-app digital-payment provider that’s available within the U.S. only. It’ll be a while for Venmo to compete with Payoneer’s immense range of e-payment solutions.

Other Competitors

TransferWise is another key payment platform player that facilitates in helping its users transfer money between two countries. Like Payoneer, TransferWise also offers competitive currency conversion fees, but they do not charge currency exchange fees, unlike Payoneer. Although TransferWise has a fewer market of 50 countries than Payoneer’s 200 plus countries and currencies. Here are other payment apps you can use for safe transactions.

Our Verdict: Is Payoneer Worth Using?

Up to this date, Payoneer boasts over four million consumers worldwide. Its payment services can be accessed from over 200 countries allowing its users to take advantage of international payments. However, due to its market choice, it cannot be used for personal money transactions – which gives rise to the first downside in this review, especially if your transactions are more personal rather than business-driven. With Payoneer, there’s just no way of sending or receiving the money to or from your relatives who are based elsewhere. Thus, Payoneer’s market is quite restrictive, especially now that more and more people would opt to do their day-to-day money transactions digitally regardless of whether it’s paying for their Airbnb or just a friend owes money to. So with these insights, we give you two takeaways for this section as this is a review on the platform after all.

When Is Payoneer More Reliable?

If you are a freelancer or a service provider and your clients are from marketplaces like Upwork, Payoneer can indeed be your best resource for you to get paid by your clients. Small to medium-scale businesses can also take advantage of paying for their routine transactions between their supply-chain and international partners.

When Is Payoneer Not Reliable?

If you’re considering Payoneer as a digital-payment platform for your regular necessities like transferring funds to your friends or family, Payoneer doesn’t provide that flexibility. Aside from this restriction, it also has its limits on specific business transactions. Payments have a limit of 15,000 USD/15,000 EUR/15,000 GBP when using a credit card. A limit of up to 15,000 USD is also set when using eCheck. For payments, whether local or international transactions, users are only limited to transfer up to 100,000 USD per month. Thus, for larger transactions, you may want to consider other e-payment systems. In essence, Payoneer is a reliable resource concerning your daily business tractions. However, for personal day-to-day fund transfer, it still has to improve to cater to this need. Overall, in terms of functionality, Payoneer still offers a competitive e-payment solution as well as transfer rates. As more and more e-commerce emerges internationally, Payoneer is a smart choice for your business needs.